Introduction

Real estate has always been one of the most popular investment choices in Pakistan. From buying plots in Islamabad to commercial plazas in Karachi, property is seen as a safe way to grow wealth. But what if you could invest in real estate without buying a whole building or plot? That’s where REITs (Real Estate Investment Trusts) come in.

In this guide, we’ll explain what REITs are, how they work in Pakistan, and why they could be the future of smart investing.

What is a REIT?

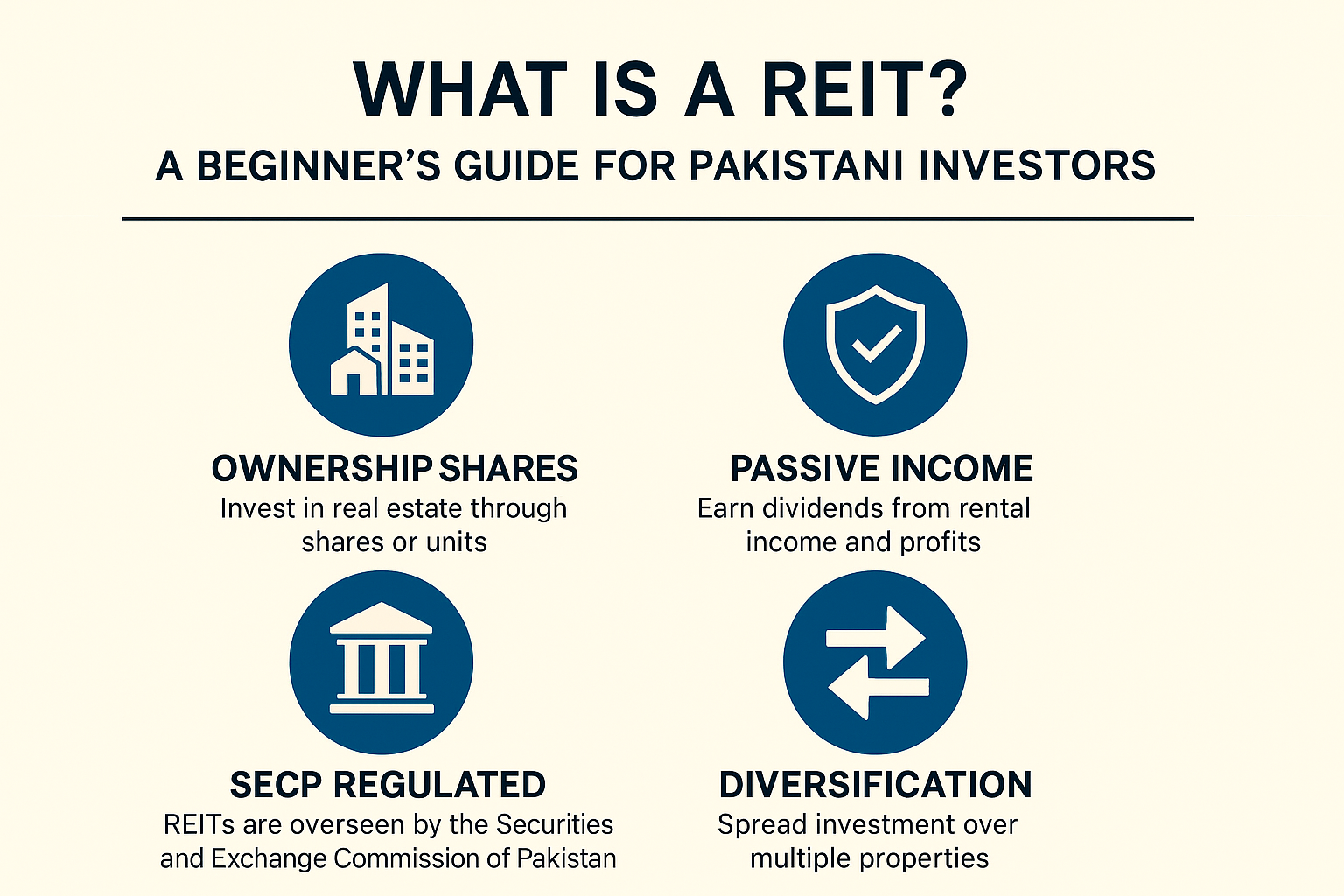

A Real Estate Investment Trust (REIT) is like a company that owns, operates, or finances income-generating real estate. Instead of a single person buying a property, many investors pool their money together. In return, each investor gets shares or units in the REIT, just like buying stock in a company.

In simple words:

- A REIT lets you own a share of real estate without actually owning the whole property.

- You earn from rental income, property sales, or capital appreciation, depending on the REIT structure.

How REITs Work in Pakistan

In Pakistan, REITs are regulated by the Securities and Exchange Commission of Pakistan (SECP). The Central Depository Company (CDC) usually acts as the trustee to protect investors’ money.

Here’s the process:

- A REIT Management Company (RMC) creates the REIT.

- Investors (like you) buy units in the REIT, starting from small amounts (e.g., as low as Rs. 20,000 in some cases).

- The REIT invests in real estate projects — such as malls, apartments, office towers, or mixed-use developments.

- Rental income and profits are distributed back to investors as dividends.

Examples in Pakistan include:

- Dolmen City REIT (Karachi) – backed by Arif Habib Group.

- Taj Boulevard Tower REIT (Islamabad) – an upcoming high-rise with luxury apartments and commercial floors.

Benefits of REITs for Pakistani Investors

1. Small Investment, Big Asset

You don’t need crores to own property. Even with a small amount, you can own a share of prime projects like malls or luxury towers.

2. Trustworthy & Regulated

REITs are approved by SECP and monitored by CDC, which makes them more secure than informal property deals.

3. Passive Income

Investors earn regular dividends from rental income and project profits without the hassle of tenants, paperwork, or maintenance.

4. Easy Exit

Unlike traditional property where selling takes months, REIT units can be bought and sold in the stock exchange, giving you flexibility.

5. Diversification

Instead of putting all your money in one plot, a REIT spreads investment across multiple projects, reducing risk.

Risks You Should Know

Like any investment, REITs also come with risks:

- Market Risk – Property values can go up or down.

- Liquidity Risk – Some REITs may have fewer buyers, making it harder to sell units quickly.

- Management Risk – The success of the REIT depends on the expertise of the management company.

That’s why it’s important to invest only in government-approved REITs with trusted names.

Why REITs Could Be the Future in Pakistan

With rising property prices, not everyone can afford to buy a flat or shop. REITs democratize real estate investment by allowing middle-class and overseas Pakistanis to invest with small amounts.

As Pakistan’s real estate sector grows, REITs will likely play a major role in bridging investors with mega projects like shopping malls, hotels, and high-rise towers.

Final Thoughts

A REIT is a bridge between stock investing and real estate. For Pakistani investors, it offers the chance to invest in big projects with small money, enjoy rental income, and grow wealth safely under SECP’s eye.

If you’ve ever wished to own a part of iconic projects like Centaurus Islamabad or Dolmen Mall Karachi, REITs make it possible — without needing crores.

Thinking of starting your REIT investment journey? Always research the REIT management company, check SECP approvals, and start small.

One response

Nice Blog